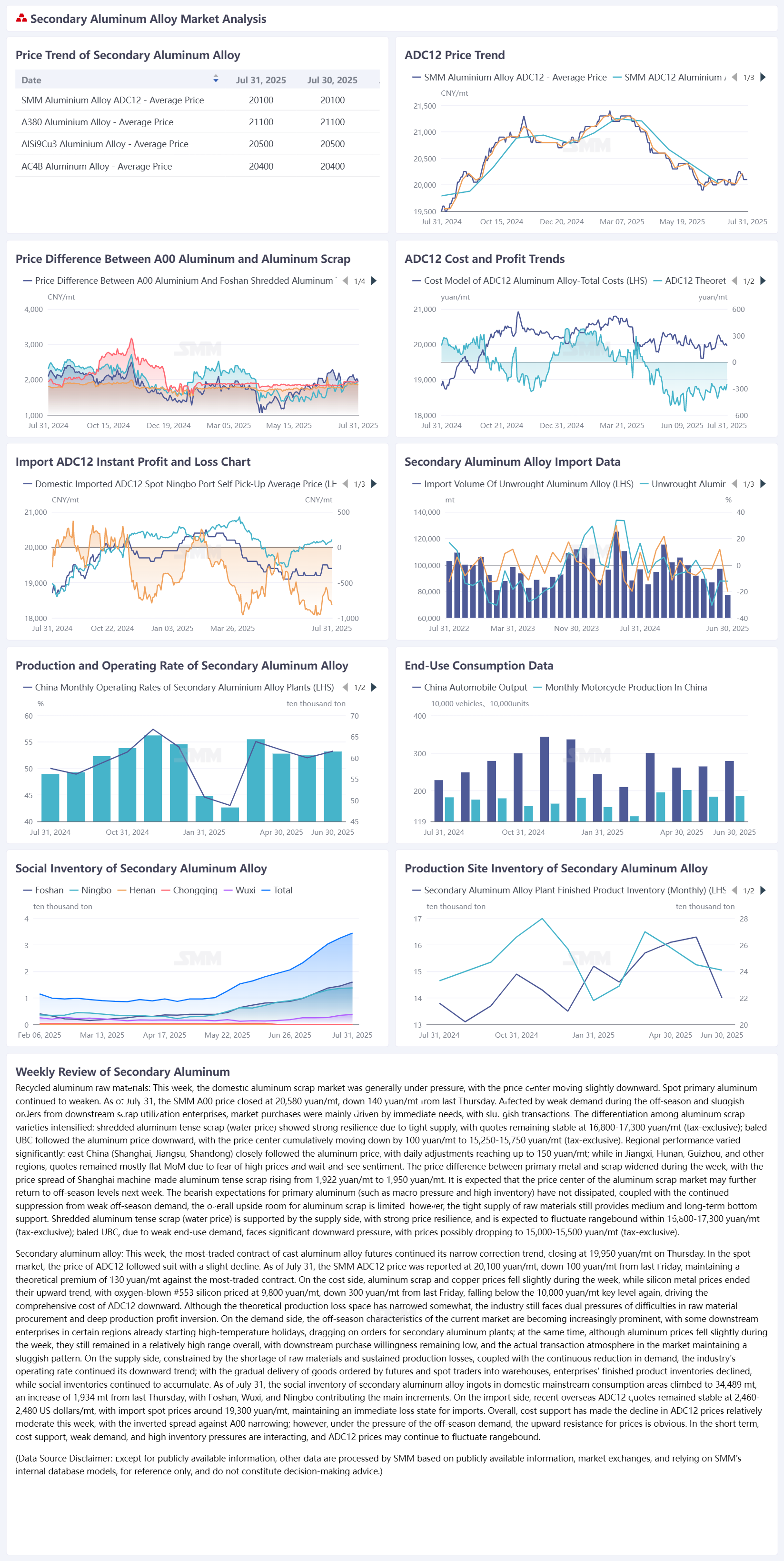

Recycled aluminum raw materials: This week, the domestic aluminum scrap market was generally under pressure, with the price center moving slightly downward. Spot primary aluminum continued to weaken. As of July 31, the SMM A00 price closed at 20,580 yuan/mt, down 140 yuan/mt from last Thursday. Affected by weak demand during the off-season and sluggish orders from downstream scrap utilization enterprises, market purchases were mainly driven by rigid demand, with sluggish transactions. The differentiation among aluminum scrap varieties intensified: shredded aluminum tense scrap (water price) showed strong resilience due to tight supply, with quotes remaining stable at 16,800-17,300 yuan/mt (tax excluded); baled UBC followed the aluminum price decline, with the center moving down by 100 yuan/mt to 15,250-15,750 yuan/mt (tax excluded). Regional performance varied significantly: east China (Shanghai, Jiangsu, Shandong) closely followed the aluminum price, with daily adjustments reaching up to 150 yuan/mt; while in Jiangxi, Hunan, Guizhou, and other places, quotes remained mostly flat MoM due to fear of high prices and wait-and-see sentiment. The price difference between primary metal and scrap widened during the week, with the price spread of Shanghai machine-made aluminum tense scrap increasing from 1,922 yuan/mt to 1,950 yuan/mt. It is expected that the price center of the aluminum scrap market may further return to off-season levels next week. The bearish expectations for primary aluminum (such as macro pressure and high inventory) have not dissipated, coupled with the continued suppression of weak demand during the off-season, the overall upside room for aluminum scrap is limited; however, the tight supply of raw materials still provides medium and long-term bottom support. Shredded aluminum tense scrap (water price) is supported by the supply side, with strong price resilience, and is expected to fluctuate rangebound at 16,800-17,300 yuan/mt (tax excluded); baled UBC, due to weak end-use demand, faces significant downward pressure, and prices may fall to 15,000-15,500 yuan/mt (tax excluded).

Secondary aluminum alloy: This week, the most-traded cast aluminum alloy futures contract continued its narrow correction trend, closing at 19,950 yuan/mt on Thursday. On the spot side, the ADC12 price followed suit with a slight decline. As of July 31, the SMM ADC12 price was reported at 20,100 yuan/mt, down 100 yuan/mt from last Friday, maintaining a theoretical premium of 130 yuan/mt against the most-traded contract. On the cost side, aluminum scrap and copper prices fell slightly during the week, while silicon metal prices ended their upward trend, with oxygen-blown #553 silicon prices reported at 9,800 yuan/mt, down 300 yuan/mt from last Friday, falling below the 10,000 yuan/mt key level again, driving down the comprehensive cost of ADC12. Although the theoretical production loss space has narrowed somewhat, the industry still faces dual pressures of difficulties in raw material procurement and deep production profit inversion. On the demand side, the off-season characteristics of the current market are becoming increasingly prominent, with some downstream enterprises in certain regions already starting high-temperature holidays, dragging on orders for secondary aluminum plants; at the same time, although aluminum prices fell slightly during the week, they still remained in a relatively high range overall, with downstream purchase willingness remaining low, and the actual transaction atmosphere in the market maintaining a sluggish pattern. On the supply side, constrained by the shortage of raw material supply and continuous production losses, coupled with the continued reduction in demand, the industry's operating rate continued its downward trend; with the gradual delivery of goods ordered by futures and spot traders in the early stage, enterprises' finished product inventories showed a decline, while social inventories continued to accumulate. As of July 31, the social inventory of secondary aluminum alloy ingots in domestic mainstream consumption areas climbed to 34,489 mt, an increase of 1,934 mt from last Thursday, with Foshan, Wuxi, and Ningbo contributing the main increments. On the import side, recent overseas ADC12 quotes remained stable at 2,460-2,480 US dollars/mt, with import spot prices around 19,300 yuan/mt, maintaining an immediate loss state for imports. Overall, cost support has made the decline in ADC12 prices relatively moderate this week, with the discount against A00 narrowing; however, under the pressure of the off-season demand, the upward resistance for prices is obvious. In the short term, cost support, weak demand, and high inventory pressures are interacting, and ADC12 prices may continue to fluctuate rangebound.